Fee Transparency Drives Double Digit Conversion Increase

Can increased friction in a loan funnel lead to increased conversion? When we increased fee transparency for our largest product, more customers trusted us to solve their money needs.

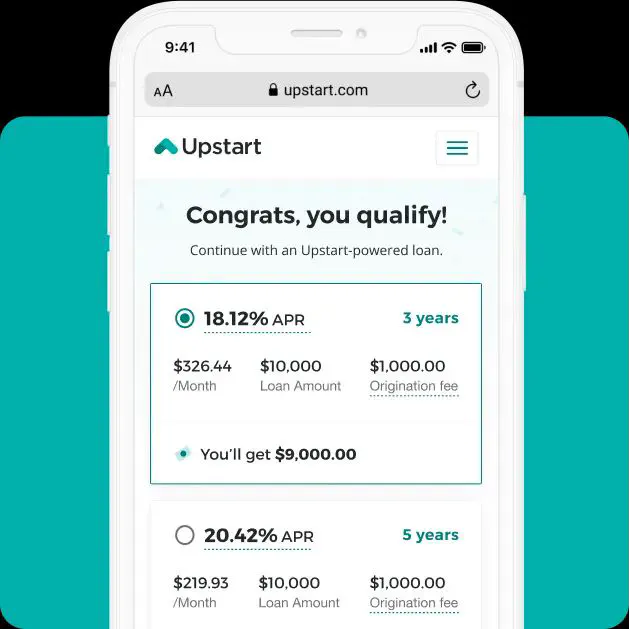

Winning UX candidate: Upstart (2025)

Winning UX candidate: Upstart (2025)If you take out a loan for $5,000, you often expect to get $5,000 at the end of the process, right? That’s what our users were telling us in the feedback we read each and every day.

By clarifying how origination fees are applied (deducted from the cash disbursed at origination), and providing users with tools to choose a loan amount that ensured they received all of the funds they expected, we increased overall conversion by an equivalent of 10%.

The increased transparency and reduced cognitive burden of selecting the right amount drove greater trust that reduced user hesitation and helped more users obtain the loan proceeds they needed.

Problem

Despite always displaying to users the origination fee our lending partners may charge for a given loan, our product team was receiving consistent feedback that users were not only surprised at the origination fee, but they were also not receiving all of the funds they needed to solve their money problem (e.g. consolidating credit card debt, making a big purchase, etc.). This was particularly challenging feedback because later steps in the loan process clearly and consistently identified the final amount of loan proceeds disbursed to users.

After empathetic research and user interviews, our team discovered that the mechanics of the origination fee coupled with the limited tools available to users to choose exactly the loan amount required to disburse their desired amount of funds were the primary issues.

Solution

Our team tested solutions to address each part of the problem:

- Visibility: Clearly identifying “how much you get” after the origination fee is applied

- Control: Tools to allow users to precisely select a loan amount that ensured they received the funds they desired

It was relatively difficult to ascertain without testing at scale just how acute the problem was, both in frequency and severity. If many users experienced this disappointment, the increased friction of additional details about each loan offer might prove useful. However, if only a few users experienced the issue, we might need to choose an intervention that was most likely to target these users specifically.

We identified two separate experimental treatments that solved for both of these dimensions. The first (“additional offer”) presented multiple offers, one that offered less than a user might desire, and one that offered exactly the final loan amount the user might expect. The second option (“opt-in”) allowed a user to select a loan offer as normal, but presented an additional option to “opt-in” to an option that provided the funds they might expect. Both options clearly articulated the amount that a user “got” after the origination fee.

Results

When we ran two candidates, each as a separate A/B test against our existing funnel, we found that the more subtle “opt-in” intervention vastly outperformed the existing funnel and even outperformed the “additional offer” to a statistically significant degree. Ultimately, this winning candidate returned an equivalent conversion rate of 10% and was easily green-lit as our full-time flow, helping us build trust with our users.

It is often the case that users who traverse the funnel faster tend to convert at a higher rate, and we also observed that the increased transparency and trust enabled users to complete the loan process at a faster rate.